As we reach the end of 2020 we all have a chance to reflect on this year’s main events. Most will point to the pandemic, its subsequent lockdowns, the political instability, the election etc.

In Finance, though, perhaps one of the most significant events has been the rise of Robinhood and the influx of young, inexperienced, speculative new traders into the market.

A lot has been written about this phenomenon (by CNBC, SeekingAlpha, Bloomberg, and NY Times, just to name a few). In fact, there are some funds and firms out there researching this further in order to come up with possible trading strategies to take advantage of it. But aside from pushing up beaten down stocks and contributing to, some would say, the forming of financial bubbles in some names, nowhere has their impact been as noticeable as in the options market. One of the hedge funds I co-founded uses options strategies as one of our main tools and we have noticed an impressive increase in option trading volume in 2020. The reality is that we had been observing a pattern of increased option interest for a few years, but this year’s surge has been impressive.

In fact, as Goldman Sachs reported in July of this year, single stock options trading volumes were bigger than the actual underlying stock shares volume for the first time ever in history.

While shocking, it comes as no surprise that cash-strapped, risk-hungry, young new traders are attracted to options, as the leverage they offer is exceptional, and one can make very large returns if their prediction comes to pass. Buying call options on almost any name in March this year would have been immensely profitable, and a lot of new traders jumped on this bandwagon. While this was happening most professional funds, ours included, were designing hedging strategies to survive or profit from further potential downside moves, which never actually happened.

This means that possibly, for a few weeks this year, random Robinhood option traders significantly outperformed the ‘smart money’ crowd.

This is a double-edged sword.

While it is certainly exciting to experience high returns on your first ever trades, it conditions a lot of these new traders into believing that the strategies they put on are more valuable than they really are.

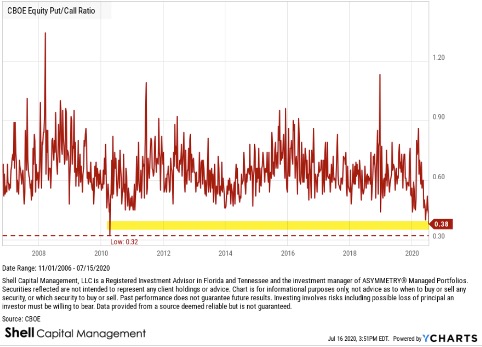

As a result, it is not surprising that this year’s put-to-call ratio has dipped to one of its lowest readings ever, suggesting that most option players are using options for bullish speculation (by buying calls) rather than for risk hedging or bearish speculation (buying puts).

That this is happening in 2020, a year when the worldwide economy has been crushed by the pandemic, is ironic to say the least.

In the long term, this is unlikely to be sustainable.

Buying calls in markets with inflated valuations might work for a while but, as history tells us, the situation will revert back to its mean at some point. This is not to say that the markets will turn bearish, it’s just a comment on the mechanics of the option market. If a constant bull market, fuelled by inflation and the dollar’s devaluation, is the new normal, then option premiums will also increase, making call buying more expensive and lowering the odds of success of call buyers

The reality is that, in the long run, most retail option buyers will end up losing money.

The only reason buying options has such an attractive risk/return proposition on paper is because the odds of success when buying options are low. Otherwise nobody would be willing to sell these instruments.

However, this influx of mostly call buyers presents a lot of opportunities for hedge funds and other professional players. Short option strategies that seek to sell options with inflated premiums to speculative unsophisticated traders are showing significant returns. This is because options trading is much more complex than it seems. Aside from the price of the underlying stock (delta) you need to at least take into account the option’s time (theta) value and its volatility (vega) values. Very few of the Robinhood traders are doing anything like that, which means there is significant value to be captured by exploiting this anomaly.

So if you have been trading options on Robinhood, I would suggest you keep track of what is and what isn’t working for you, and try to educate yourself about the complex world of options before you risk a lot of your capital.

If admitted to the TrendUp Now program, during the L2 course we will take a deep dive into the option strategies that we use day in and day out at our fund, and that we have been successfully running for years now. They may not be as initially enticing as buying cheap calls and striking it rich, but they are much more regular and consistent.

At the end of the day, the intelligent investor who is able to generate superior risk-adjusted returns on a consistent basis will always beat the speculator who had perhaps gambled and been lucky a few times. The latter, at the end of the road, through a string of bad trades, will likely lose most of what he once gained.